This depends upon the bank though, and unless you have a savings account that tracks the base price, a boost isn't ensured. Just like with fixed-rate home mortgages, with fixed-rate savings, you deal with right into a rate for a collection time period, for one, 2, 3 or even 5 years. Normally you're provided a somewhat higher rate for dealing with than you would with an easy-access price item, with the lengthiest solution paying one of the most. So, if you need to brush up on what the base price is - or you've merely never ever become aware of it - below's our explainer, and also just how it affects home loans, cost savings, bank card, finances and more. Home loan interest rates have a considerable influence on the overall long-term cost of buying a home via financing.

- When your fixed-rate deal concerns an end, if you don't remortgage onto another offer it returns to your loan provider's common variable rate.

- When debating whether to lease or buy, there are several costs to keep in mind.

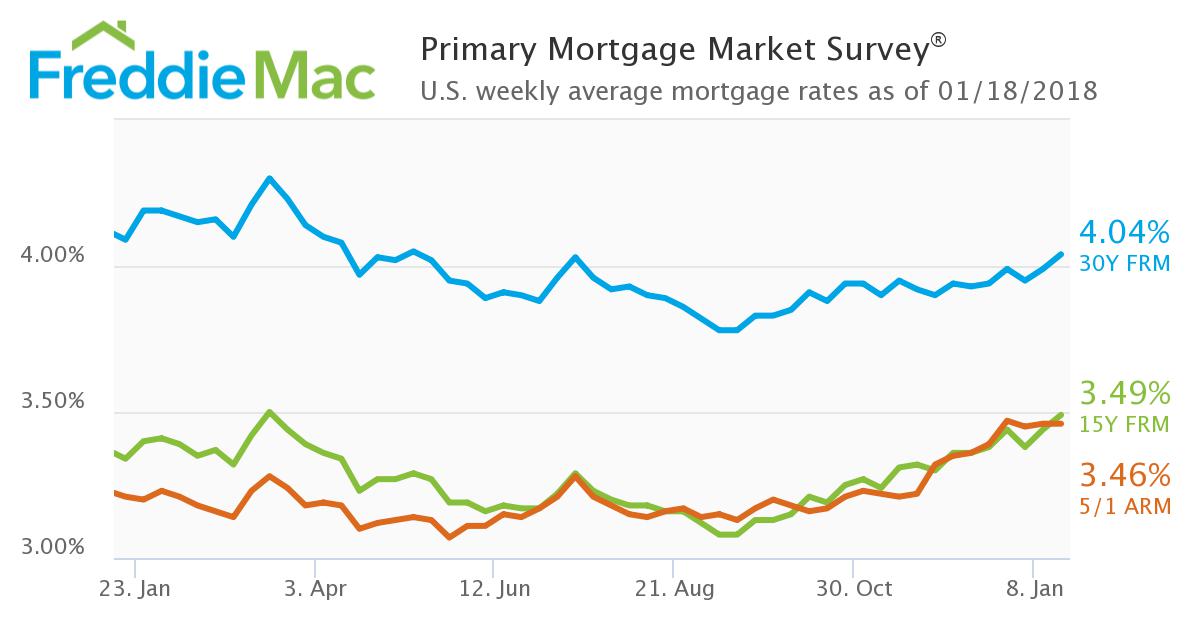

- Interest rates, similar to gasoline prices, can fluctuate daily and also from year to year.

- A few of the underlying aspects are complicated, however comprehending these concepts explains the interest rates you are paying now and what can be coming in the future.

Additionally, several fixed-rate investments, like ensured interest options or guaranteed investment certificates, can provide you greater returns. You can likewise collaborate with a consultant to upgrade your Additional resources common funds and also segregated funds plan to aid you take advantage of greater rates of interest. After ending the bond acquisitions, the Fed is anticipated to raise the government funds rate for the very first time considering that 2018.

Share This Story: Numerous Canadians Unsure How Rising Rates Of Interest Influence Home Loans

Bond costs and home mortgage interest rates have an inverted relationship with each other. That implies that when bonds are a lot more pricey, home loan prices are lower. The opposite is additionally real-- when bonds are cheaper, home mortgage interest rates are greater. We'll also have a look at which kinds of home loans https://waylonogqc172.weebly.com/blog/reverse-mortgage-definition show the impacts of the bond market on their home loan rates.

Time To Save?

On top of that, the Federal Reserve has an effect by acquiring various possessions, particularly Treasuries, as a means to influence costs as well as rates. There are a number of broad categories of mortgage, such as standard, FHA, USDA, and also VA loans. Lenders make a decision which products to offer, and funding types have various eligibility requirements. Rates can be substantially various relying on what finance kind you select. Talking to multiple lenders can aid you much better recognize all of the alternatives readily available to you. Your initial rate of interest may be reduced with an adjustable-rate finance than with a set price car loan, but that price could increase dramatically later.

Dealt With

Interest rates, just like fuel prices, can fluctuate daily and also from year to year. While motion in the rates of interest market is outside of your control, it makes good sense-- just like with gas rates-- to gain recognition concerning what's normal. This way, you'll have a feeling of whether an interest rate quote you obtain seems in the variety of typical rates, or if you must ask extra concerns and remain to search. The Federal Book likes to maintain rates Visit this link of interest for obtained funds reasonably low for customers because it motivates acquiring, which keeps the economic climate going. Nonetheless, this needs to be stabilized against inflation and the desire for money saved to go additionally. This leads to a push-pull when it concerns increasing and also cutting rate of interest.